Upi paynow

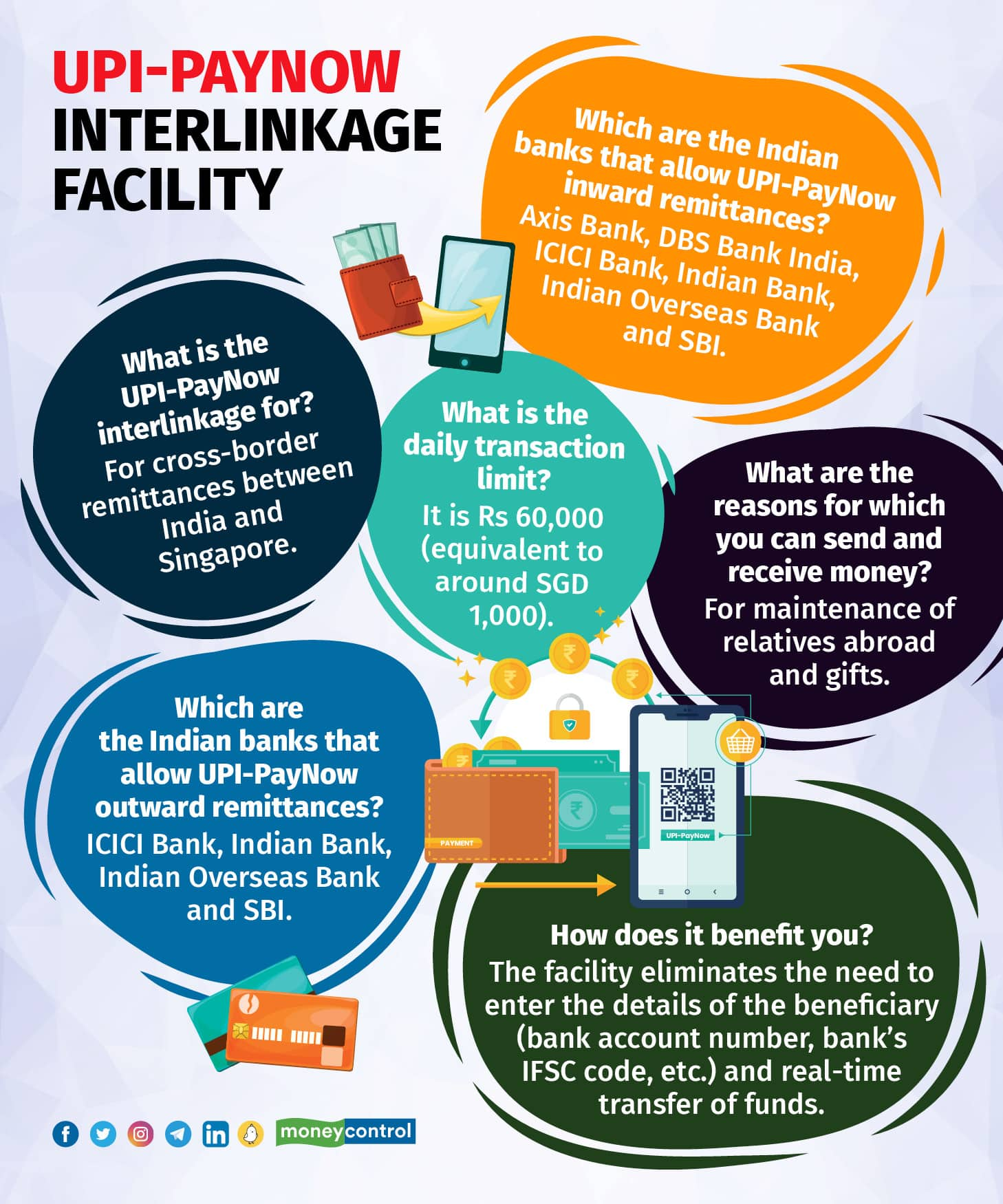

Web 1 day agoIndia has officially linked its flagship online payment system UPI with PayNow the online payment system of Singapore for seamless cross-border transactions. India and Singapore on Tuesday linked.

7g9uz3fw3qgvcm

Web 2 days agoUPI-PayNow transfer limits.

. Web 1 day ago24 hours ago. Just like UPI in India people can send and receive funds from one bank or e-wallet account to another. Web 2 days ago1 min read.

Web 2 days agoUPI payments through QR codes are already taking place in Singapore though at a limited number of outlets. Starting today Indians will be able to use UPI to make faster easier and cheaper. Web The PayNow-UPI linkage will enable users to make instant low cost fund transfers directly from one bank account to another between Singapore and India.

Web The PayNow-UPI tie-up is the first of its kind to use scalable cloud-based infrastructure that can accommodate future increases in the volume of remittance traffic. Web The UPI-PayNow linkage is a significant milestone in the development of infrastructure for cross-border payments between India and Singapore and closely aligns. Web Similar to Indias fast payment system - UPI - PayNow is Singapores counterpart.

Web Indias UPI to be linked with Singapores digital payments platform PayNow. Web 1 day agoThe PayNow-UPI real-time cross-border payments linkage is the result of extensive collaboration between MAS RBI payment system operators in both countries. With the launch of the Real-Time payment Systems Linkage between India and Singapore today customers of participating banks.

Web 2 days agoThe initiative of linkage between Indias Unified Payments Interface UPI and Singapores PayNow by the Indian Government is a crucial development in the nations. Delighted to launch the linkage between PayNow and. Web 2 days agoThe UPI-PayNow linkage will enable all users of the two payment systems in either country to make convenient safe instant and cost-effective cross-border money.

Indias Unified Payments Interface UPI and Singapores PayNow have been linked for cross-border money transfers the Reserve Bank of India RBI. With just a mobile number users can send and receive funds from one bank. A collaboration project of Indias Reserve.

Customers can undertake cross-border remittances to Singapore using the banks mobile banking app internet banking. Web The UPI-PayNow linkage will now enable users to make faster payments at low-cost on a reciprocal basis without the need to use any other payment systems. 21 Feb 2023 1123 PM IST Shayan Ghosh.

Web The UPI-PayNow linkage will enable users of the two fast payment systems in either country to make convenient safe instant and cost-effective cross-border funds. We all know how UPI revolutionised domestic payments and we are now going. Web 2 days agoThe UPI-PayNow interlinkage is a milestone moment for cross-border transfers.

Web On Tuesday UPI-PayNow was officially launched by Singapores PM Lee Hsien Loong and Indias PM Narendra Modi. PayNow is Singapores fast payment system. Web 2 days agoUPI-PayNow Linkage 2023.

Web According to the RBI press release The UPI-PayNow linkage is the product of extensive collaboration between Reserve Bank of India RBI Monetary Authority of. Web 2 days agoWhat is PayNow. UPI linked to Singapores PayNow for fast transfers.

9yltsbc6unbcfm

4c14zghpc3bqum

M7 Rkxocrilvum

Xdgpwzzsnqhsnm

Dcq84rbdjrau2m

Xa7ypa9 Tqbf0m

Bfhtkfic0avgxm

T 0joboxvxmadm

Hqdwcpth1v98tm

Wotcscgimiykfm

Yr4y0z1fwxu2 M

C3bwjnqoee8xmm

Cvpu6spduacvdm

0lp8gzxpe1fbrm

Sxphnlfz8fzuqm

Vpddktky6qe6pm

Lqxvjtzjobnwem